Reasons PNP Retirees Face Financial Difficulties

There

isn’t a single task a man undertakes that can be described as simple and free

of difficulties. Undeniably, a police officer’s job is not one that anyone can

launch at any time because it involves putting more than just physical prowess

and firearms on the line.

PNP

personnel risks their lives for the commitment to serving our country. Even

their family safety is affected as well.

When

they cannot perform their duties, their pension benefits are the saving armor

of their retirement. But how come PNP retirees still struggle financially after

leaving the PNP service despite the honor and commitment they have shown to the

nation?

Though

the Financial Institutions, under the umbrella of the National Government, have

provided good benefits and life security plans to PNP personnel, several

retirees still face financial difficulties after they retire from the service.

Why

did this happen?

This

post explains why PNP retirees have trouble with money after they leave the

service and points out important factors in their retirement benefits.

Insufficient

Funds

According

to a report, the government raised the pay of active police and military

personnel in 2018 while delaying the pay increase for retirees for a few years.

As a result, the government is currently paying in installments on this, and

the process is prolonged. It will take another five years to pay the remaining 26

months fully. With this, many retirees have already died not receiving their

full retirement benefits.

Not

Every Retiree Received Compensation

Before

the Arroyo administration, the Department of Budget and Management always made

the Funds available to compensate retirees fully.

However,

before the release of this fund, rumors circulated that it would only include

PNP retirees who had paid their annual dues.

These

are all rumors without evidence, but the PNP leaders

have not provided an explanation to prevent speculation and other conspiracy

theories from expanding.

Rely

on one source of income

Most

police officers rely on one source of income, and that is the salary from their

job.

We

know that our organization focuses on public service, but it doesn’t prohibit

us from pursuing business or earning passive income as long as there’s no

conflict of interest involved. Some personnel retired from the service without

having a side hustle or what we call a “sideline” business.

There

are two types of income: active income and passive income.

Active

income is essentially when you get paid for your time—meaning

you’re exchanging your time or service for money. For example, your employment

as a police officer where you spend hours at your job. It’s active because in

order to get paid or receive your salary, it requires your work, your time, and

energy.

The

other type of income that is superior to active income that every PNP personnel

should be aware of and strive for because it allows you to make more money is

passive income.

Passive

income is the income you receive that does not involve any

further work on your part. Others would call it “earning money while

you sleep.”

Examples

of passive income are house or car rental income, investment dividends, earning

interest from the bank, and other things that require little to no effort.

It’s

no surprise that most uniformed personnel put their extra money in Armed Forces

and Police Savings and Loans Association, Inc. (AFPSLAI) because of its highest

dividend rate of 16% per year or 4% per quarter.

Follow

Robert Kiyosaki’s principle — never put your money in a bank. A great example of

this is putting your hard-earned money to AFPSLAI. AFPSLAI is not a bank but

rather a private non-bank financial institution regulated by the Bangko Sentral

ng Pilipinas (BSP).

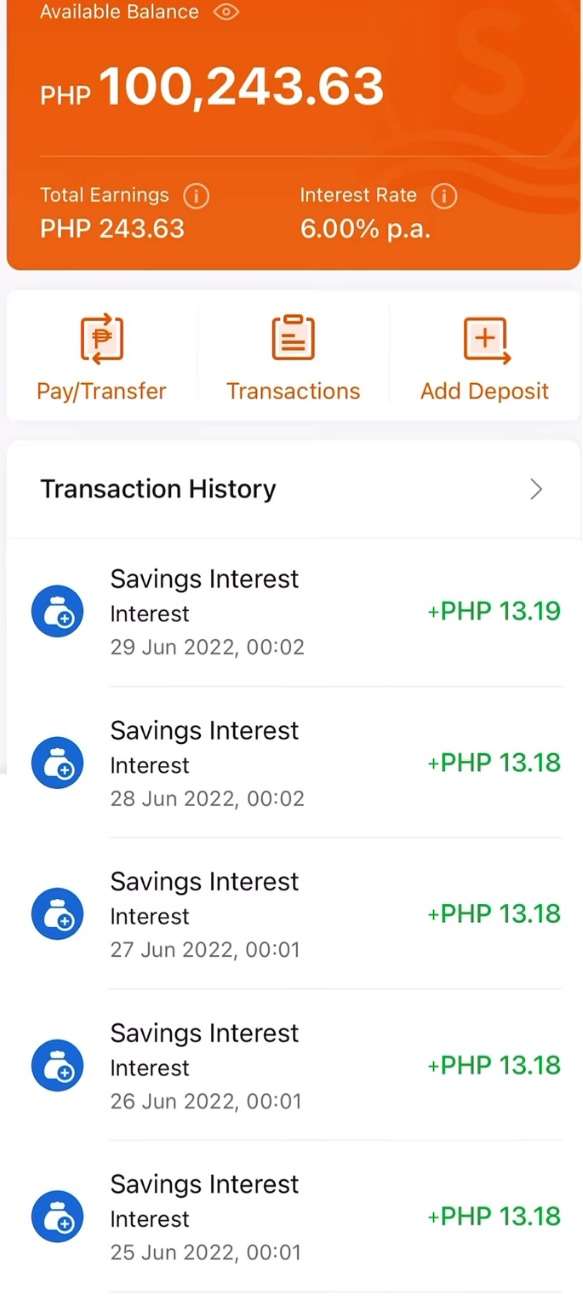

If

you are not comfortable with AFPSLAI, other option would be digital bank that

offers highest interest rate like Maya (formerly PayMaya) with 6% interest rate per

annum and Seabank with 6% interest rate per annum.

Seabank

pays interest on a daily basis, while Maya pays interest on a monthly basis. These

digital banks do not implement a lock-in period, meaning you can withdraw your

money anytime.

In

active income, you work for money, while in passive income, money works for

you.

PNP

Retirement Benefits

The

PNP retirement benefits may affect after 20 years of service; the total monthly

pension is 50% of the retired grade’s basic salary and longevity pay. Its

percentage goes up 2.5% each year after 20, reaching a maximum of 90% for 36

years of service.

However,

there’s an exception for uniformed personnel who can choose to get retirement

pay all at once and in advance for the first five years. It will pay it in full

within six months of retirement or completion.

In

addition, it will add the PNP officers’ and non-officers pension benefits based

on the active duty wage scale. The officer is entitled to a year’s salary, a

pension equal to 80% of his last wage for life, and other benefits as provided

by law.

If

a member who retired under this section dies within five years of retirement,

his surviving lawful spouse or, if no such spouse exists, his surviving

dependent legitimate children are qualified for the pension for the rest of the

five-year insured period.

Here

are the detailed explanations of who are the legal surviving heirs of the

deceased retiree:

Surviving

Spouse

A

legal partner or spouse may claim survivor benefits for a derivative pension or

pension transfer; if they were lawfully married to the departed PNP pensioner

just before the former’s retirement or separation and have not neglected the recently

dead PNP pensioner without justification.

Other Survivors

The surviving lawful, legitimated, and legally adopted children, including any illegitimate children who are single, either under the age of majority or over the age of minority, but unable to support themselves due to a physical or mental disorder (developed before reaching adulthood), and who are not married.

Additionally,

if the surviving spouse or children are not alive, the surviving family or

parents are entitled to the claims. The surviving single siblings are allowed

to claim in the absence of the first family.

Wrapping

Up

Those

noted above are the primary reasons PNP retirees face financial difficulties

despite having adequate life insurance and substantial benefits offered during

their service.

PNP

retirees provide their all to the service throughout their lives; how come

retirees are only partially compensated for their pension benefits?

Besides

the speculations and controversies surrounding the National’s failure to

release PNP retirement benefits in 2018, many surviving families still

experience the same scenario today.

Moreover,

many retirees die without enjoying the fruits of their sacrifices because of

failure and slow disbursement of the funds from the National budget before.

For

PNP personnel who are about to retire or have opted to retire early, the remedy

(for delayed claims) is to get ready ahead of time by updating their service

records or PAIS records, breaking down their leave credits, getting clearances,

etc., so that their retirement claims can be approved and then budgeted for

DBM.

FAQs:

What

is the person’s responsibility who unjustifiably delays pension payments?

The

office may take administrative disciplinary actions against an incompetent

officer or staff member who fails or neglects to discharge a retiring

government worker’s pension, payments, or other pension benefits within the

time frames specified. Following a hearing and fair trial, the offending

officer or police officer will be paid leave for six months to a year at the

discretion of the disciplinary authority.

This

penalty does not apply if unforeseen circumstances or other unusual events

prevent the release of retirement benefits. In these cases, the thirty-day

period begins when the cause dies.

What

is the person’s responsibility who unjustifiably delays pension payments?

The

office may take administrative disciplinary actions against an incompetent

officer or staff member who fails or neglects to discharge a retiring

government worker’s pension, payments, or other pension benefits within the

time frames specified. Following a hearing and fair trial, the offending

officer or police officer will be paid leave for six months to a year at the

discretion of the disciplinary authority.

He

is entitled to one year’s salary, an entire life pension equal to 80% of his

last salary, and other compensation, in addition to other benefits specified by

law.

If

a member who has been retired under this section passes away within five years

of retirement, his surviving legitimate husband or wife, or in the absence of

one, his surviving dependent children, are entitled to the pension for the

balance of the five-year assured period.

Are

PNP employees who retire with exceptional cases eligible for a pension?

An

active civil or criminal case against a retired person does not preclude

compensation for PNP retirement benefits.

If

the authority does not suspend or resolve the case within three months of the

retiree’s retirement date, retirement benefits are released immediately,

regardless of the case’s final resolution. If a retiree’s case is being

appealed, it is legal to exempt PNP retirement benefits.